Yes, sweepstakes casino winnings are taxable. The IRS treats every dollar you redeem from sweepstakes casinos — whether it’s from Chumba Casino, Stake.us, or any other platform — as ordinary income, taxed at the same federal rates as wages or salary.

In 2026, federal tax rates on sweepstakes and gambling winnings range from 10% to 37%, depending on your total income and filing status. A major new rule also limits how much of your losses you can deduct, making tax planning more important than ever.

To make things simple, we created a dedicated Sweepstakes Casino Tax Calculator that estimates your potential federal and state tax liability before you file.

Enter your sweepstakes winnings, total income, filing status, and state to instantly see:

- Your estimated federal tax owed

- Your estimated state tax (if applicable)

- Your projected take-home amount after taxes

- The tax brackets your winnings fall into

This calculator and guide are provided for educational purposes only. Sweepedia is not staffed by tax professionals, and nothing here constitutes tax, legal, or financial advice. Tax laws vary by state and change frequently. Always consult a qualified CPA or tax advisor before filing your return.

How Are Sweepstakes Casino Winnings Taxed in 2026?

Sweepstakes casino winnings are taxed as ordinary income at the federal level — the same way the IRS taxes wages, freelance income, or traditional casino winnings. This applies whether you receive your payout as a Sweeps Coins redemption, a gift card, or a direct bank transfer.

If you redeemed cash prizes from a sweepstakes casino in 2026, that money must be reported as taxable income on your federal return. The payout method does not change the tax treatment.

One of the most common misconceptions among sweepstakes casino players is that winnings aren’t “real” income because these platforms use virtual currencies like Sweeps Coins and Gold Coins. That is not how the IRS views it.

The moment Sweeps Coins are converted into cash or prizes — whether it’s $50 or $50,000 — the value becomes reportable income. The sweepstakes legal structure does not reduce or eliminate your tax obligation.

Here’s what actually matters for your 2026 tax situation:

- All winnings must be reported, even if the casino does not send you a tax form. There is no minimum amount that exempts you from reporting income.

- Automatic federal withholding of 24% applies when a single prize exceeds $5,000 (net of the wager, if applicable). The casino withholds this amount before paying you.

- Your actual tax rate depends on total income. The 24% withholding rate is only an estimate — you may owe more or less when you file based on your tax bracket.

- State taxes may also apply. Some states charge no income tax, while others add up to 10.9% on top of federal taxes.

Even casual players who redeem only a few hundred dollars should report their winnings. Sweepstakes casinos submit copies of Form 1099-MISC to the IRS when required, and mismatches between what platforms report and what you file can increase audit risk.

2026 Federal Tax Brackets for Gambling and Sweepstakes Winnings

The U.S. tax system is progressive, meaning your income is taxed in layers rather than at a single flat rate. When sweepstakes winnings push you into a higher bracket, only the portion above that threshold is taxed at the higher rate.

For tax year 2026, the IRS released updated bracket thresholds reflecting inflation adjustments made permanent by the One Big Beautiful Bill Act (OBBBA).

| Tax Rate | Single Filer | Married Filing Jointly |

|---|---|---|

| 10% | $0 – $12,400 | $0 – $24,800 |

| 12% | $12,401 – $50,400 | $24,801 – $100,800 |

| 22% | $50,401 – $105,700 | $100,801 – $211,400 |

| 24% | $105,701 – $201,775 | $211,401 – $403,550 |

| 32% | $201,776 – $256,225 | $403,551 – $512,450 |

| 35% | $256,226 – $640,600 | $512,451 – $768,700 |

| 37% | Over $640,600 | Over $768,700 |

Example: Suppose you are a single filer earning $55,000 from your job and redeemed $5,000 in Sweeps Coins during 2026. Your total income becomes $60,000. After the standard deduction of $16,100, your taxable income is $43,900.

In this case, your sweepstakes winnings fall entirely within the 12% tax bracket, resulting in roughly $600 in federal tax — not the 24% many players expect.

By contrast, if your salary were $100,000 and you redeemed the same $5,000, those winnings would fall into the 22% bracket, costing about $1,100 in federal tax.

This is exactly why using the calculator above — and entering your actual annual income — produces a far more accurate estimate than assuming a flat 24% rate.

NEW 2026 Rule: The 90% Gambling Loss Deduction Cap

Starting January 1, 2026, the federal government limits gambling loss deductions to 90% of your winnings, down from the previous 100%. This is the single most significant tax change affecting sweepstakes casino players in 2026.

The change was enacted as part of the One Big Beautiful Bill Act (OBBBA), signed into law by President Trump on July 4, 2025.

::contentReference[oaicite:0]{index=0}Under the old rules, if you won $10,000 and lost $10,000 in the same year, you could deduct the full $10,000 in losses, leaving you with $0 in taxable gambling income.

Under the new 2026 rule, you can only deduct $9,000 (90% of $10,000). The remaining $1,000 becomes “phantom income” — money you never actually kept, but which the IRS still taxes as real income.

This rule has specific implications for sweepstakes casino players:

- If you play regularly and your winnings roughly equal your losses, you now owe tax on 10% of your total winnings regardless.

- You must itemize deductions on Schedule A to deduct any gambling losses at all. If you take the standard deduction ($16,100 for single filers in 2026), you cannot deduct losses.

- Most casual sweepstakes players use the standard deduction, meaning this rule primarily impacts regular and high-volume players who already itemize.

Worked example: You win $8,000 playing sweepstakes casino games in 2026 and have $8,000 in documented losses. Under the old rules, your taxable gambling income was $0.

Under the 2026 rule, you may deduct only $7,200 (90% × $8,000). You now owe tax on $800 of phantom income. At a 22% marginal rate, that’s roughly $176 in federal tax on money you never actually profited.

The Joint Committee on Taxation estimates this provision will generate $1.1 billion in federal revenue over the next decade, largfully from high-volume gamblers.

The gaming industry has pushed back forcefully. DraftKings CEO Jason Robins criticized the rule as taxing “something that’s not actually income.” Rep. Dina Titus introduced the FAIR Bet Act to repeal the cap, and President Trump has suggested he may “think about” eliminating taxes on gambling winnings entirely.

For now, however, the 90% cap is the law, and sweepstakes players should plan accordingly.

Sweepstakes Casino Tax Forms: 1099-MISC vs. W-2G

Sweepstakes casinos usually issue a Form 1099-MISC — not a W-2G — when reporting player winnings. This differs from traditional casinos because sweepstakes prizes are generally classified as promotional prizes rather than gambling winnings.

Knowing which tax form applies is essential for accurate reporting.

When You’ll Receive a 1099-MISC

If you redeem a single prize worth $600 or more from a sweepstakes casino, the operator must issue a 1099-MISC and report the payment to the IRS.

You should receive this form by January 31 of the following year. This is the most common tax document sweepstakes casino players receive.

When You’ll Receive a W-2G

If a single prize exceeds $5,000, the sweepstakes casino may issue a W-2G and automatically withhold 24% federal tax before paying you.

This withholding is a prepayment toward your tax bill — you’ll reconcile the final amount owed or refunded when you file your return.

Important 2026 update: The IRS raised the W-2G reporting threshold for slot machine winnings from $1,200 to $2,000. This is the first increase since 1977 and will be indexed to inflation starting in 2027.

While this change mainly affects traditional casino players, it signals a broader modernization of gambling tax reporting.

What If You Don’t Receive Any Tax Form?

You are still legally required to report all gambling and sweepstakes winnings on your tax return, even if no 1099-MISC or W-2G is issued.

Many players win amounts under $600 across multiple platforms, meaning no single redemption triggers a reporting form. The IRS still expects this income to be reported.

Keep screenshots of redemption histories, bank statements, and casino account records. Good documentation is essential if questions arise later.

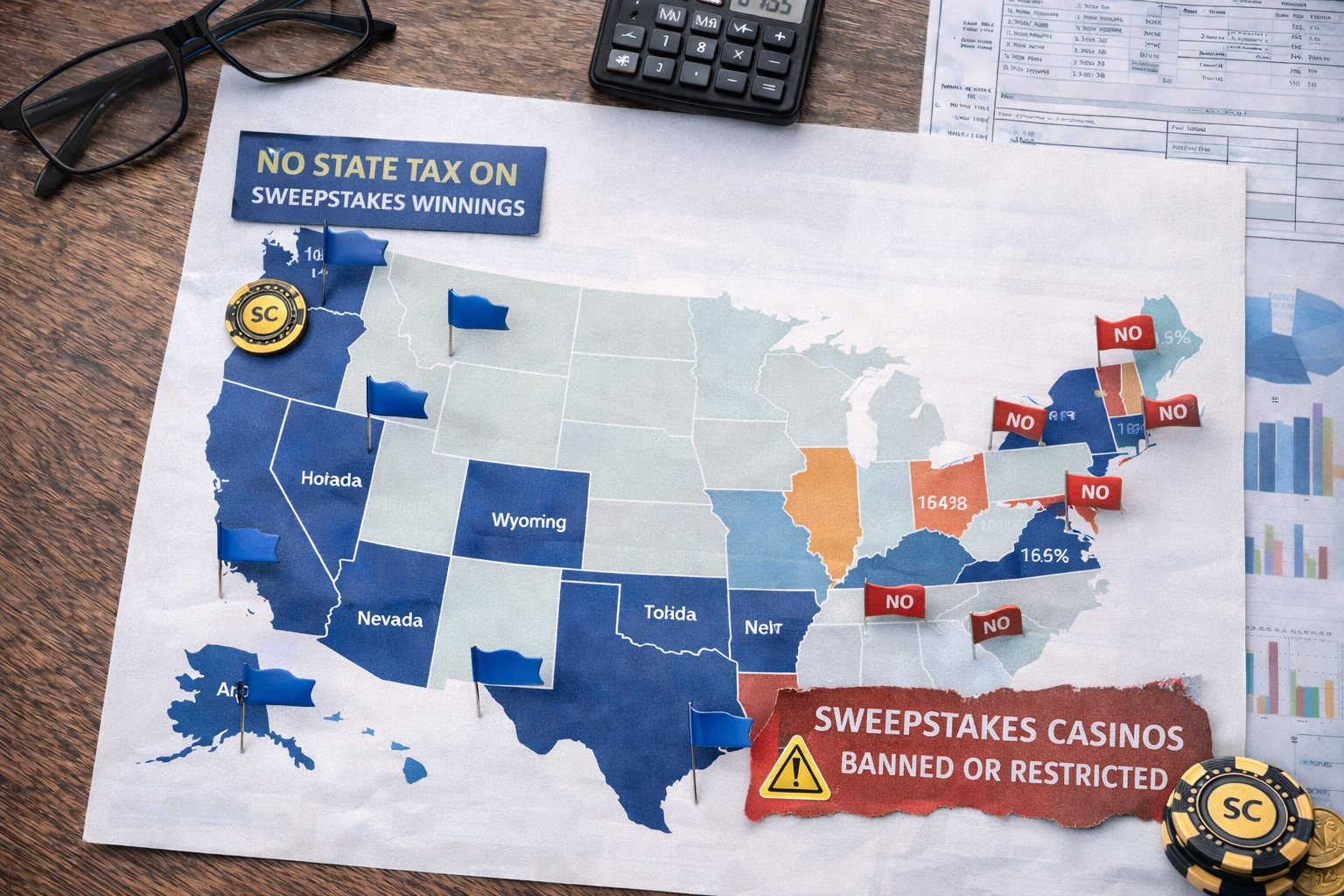

State-by-State Tax Rates on Sweepstakes Casino Winnings

Your state of residence determines whether you owe taxes on sweepstakes casino winnings in addition to federal income tax. While federal taxes apply nationwide, state tax treatment varies widely.

Nine U.S. states have no personal income tax, meaning sweepstakes winnings are subject only to federal tax. Other states impose income tax rates ranging from roughly 2% to nearly 11%.

States With No Income Tax on Sweepstakes Winnings

If you live in any of the states below, you do not owe state income tax on sweepstakes casino winnings. Federal income tax still applies.

| State | State Income Tax on Sweepstakes Winnings |

|---|---|

| Alaska | No state income tax |

| Florida | No state income tax |

| Nevada | No state income tax |

| New Hampshire | No tax on earned income |

| South Dakota | No state income tax |

| Tennessee | No state income tax on winnings |

| Texas | No state income tax |

| Washington | No state income tax* |

| Wyoming | No state income tax |

Note: California does not tax gambling winnings at the state level, but sweepstakes casinos have been banned there as of January 1, 2026, making new sweepstakes play unavailable to residents.

States Where Sweepstakes Casinos Are Banned or Restricted

Before worrying about state tax rates, confirm that sweepstakes casinos are legally available where you live. As of February 2026, sweepstakes casinos are banned or restricted in the following states:

| State | Status |

|---|---|

| Washington | Restricted / legal challenges ongoing |

| Michigan | Banned |

| Idaho | No cash prizes permitted |

| Montana | Banned |

| California | Banned effective January 1, 2026 |

| Connecticut | Banned |

| New York | Banned |

| New Jersey | Banned |

| Nevada | Banned |

| Louisiana | Ongoing lawsuits against operators |

Several additional states have pending legislation that could restrict sweepstakes casinos in the future. Always verify current availability before registering on a new platform.

Nine states — Connecticut, Illinois, Indiana, Kansas, Louisiana, North Carolina, Ohio, Rhode Island, and Vermont — do not allow itemized deductions for gambling losses on state returns. In these states, you pay tax on your gross winnings with no offset for losses, even if you itemize federally.

How to Report Sweepstakes Casino Winnings on Your Tax Return

Reporting sweepstakes casino winnings is straightforward once you know where the numbers go. Below is a step-by-step walkthrough for the 2026 tax year (returns filed in spring 2027).

Step 1: Track All Wins and Losses

Track your activity throughout the year — not just at tax time. Keep a running log or spreadsheet with:

- Date of each win and loss

- Amounts won and redeemed

- Platform name

Save screenshots of redemption histories from each platform. Many sweepstakes casinos can also provide annual account statements upon request.

Step 2: Collect Your Tax Forms

By January 31, 2027, any sweepstakes casino that paid you $600 or more in a single prize should send a 1099-MISC.

If you received a prize of $5,000 or more with 24% withheld, you’ll receive a W-2G. Check both email and physical mail — some operators only send digital copies.

Step 3: Report Winnings on Form 1040

Report your total sweepstakes winnings on Schedule 1 (Form 1040), Line 8b under “Other Income.” This includes winnings from all platforms, not just those that issued tax forms.

Step 4: Deduct Losses (If You Itemize)

If you itemize deductions instead of taking the standard deduction, gambling losses may be deducted on Schedule A under “Other Itemized Deductions.”

Remember: in 2026, losses are capped at 90% of your total winnings. You cannot deduct more losses than winnings, and losses cannot offset non-gambling income.

Step 5: Pay Estimated Taxes If Necessary

If you had significant winnings without withholding — such as multiple prizes between $600 and $5,000 — you may need to make quarterly estimated tax payments to avoid underpayment penalties.

Use IRS Form 1040-ES to calculate and submit these payments.

Tips to Reduce Your Sweepstakes Casino Tax Bill

While there is no legal way to avoid paying taxes on gambling winnings, several strategies can help minimize your overall tax burden. The tips below are tailored specifically to sweepstakes casino players and reflect the 2026 tax landscape.

Keep meticulous records from day one. The IRS places the burden of proof on taxpayers when claiming gambling losses. Save every redemption receipt, regularly screenshot your win and loss history, and maintain a simple log with dates and amounts.

If you are audited, rough estimates are not enough. You need contemporaneous records created at or near the time of play. Good documentation is your strongest protection.

Understand when itemizing beats the standard deduction. For 2026, the standard deduction is $16,100 for single filers and $32,200 for married couples filing jointly.

If your total itemized deductions — including mortgage interest, charitable contributions, state and local taxes (SALT), and gambling losses — exceed the standard deduction, itemizing can reduce your tax bill. If they do not, taking the standard deduction usually makes more sense, even though your losses cannot offset winnings.

Consolidate your play to fewer platforms. Tracking activity across many sweepstakes casinos increases the chance of errors. Focusing on two or three trusted platforms results in cleaner records and more reliable year-end summaries.

Consider the timing of large redemptions. If you expect lower income next year — due to retirement, a job change, or reduced hours — delaying a large redemption until January may place those winnings in a lower tax bracket.

This is standard tax planning, not avoidance, and can meaningfully affect your final tax bill.

Consult a CPA for large wins. If you redeemed $10,000 or more during the year, a professional tax consultation is often worth the cost.

A CPA can identify missed deductions, ensure compliance, and help you navigate the new 90% loss deduction cap. This is especially valuable in 2026, when the rules have changed significantly.

Sweepstakes Casino Tax FAQ

Do you have to pay taxes on sweepstakes casino winnings?

How much tax do you pay on sweepstakes casino winnings?

Do sweepstakes casinos report your winnings to the IRS?

Can you deduct sweepstakes casino losses on your taxes?

What is the 90% gambling loss cap in 2026?

What tax form do sweepstakes casinos use?

What happens if I don’t report sweepstakes casino winnings?

Which states don’t tax sweepstakes casino winnings?

Last updated: February 10, 2026. Tax laws and sweepstakes casino availability change frequently. Sweepedia updates this guide regularly during tax season to ensure accuracy. Federal tax data sourced from IRS Revenue Procedure 2025-32 and IRS Topic 419.